child tax credit october 2021 date

See what makes us different. The opt-out date is on October 4.

Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit.

. Child Tax Credit 2022. What is the schedule for 2021. IR-2021-201 October 15 2021.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. Goods and services tax.

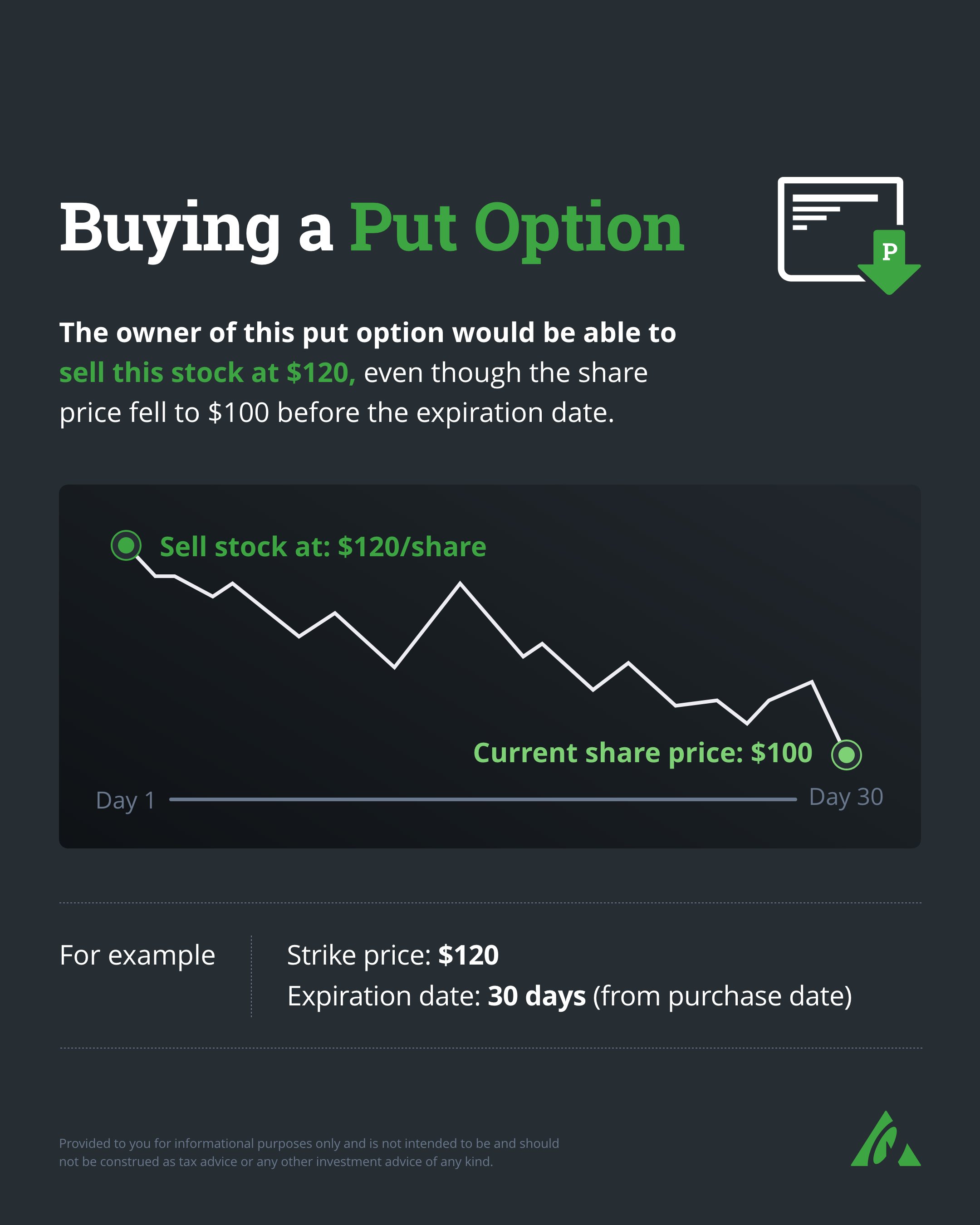

Recipients can claim up to 1800 per child. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. If a taxpayer wont be claiming the child tax credit on their 2021.

How Next Years Credit Could Be Different. Ad We Specialize in the IRS. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The Child Tax Credit has been expanded from 2000 per child annually. Simple or complex always free.

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. 15 opt out by Aug.

6 and gives all but the. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. October 20 2022.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 15 is a date to watch for a few reasons. Here are the dates for the final three Child Tax Credit payments.

December 13 2022 Havent received your payment. Call Today for a Free Initial Consultation. 1006 PM EDT October 6 2021.

Most of us really arent thinking tax returns in mid-October. Congress fails to renew the advance Child Tax Credit. There are three months left in the year and also three Advanced Child Tax Credit payment dates.

File a federal return to claim your child tax credit. President Biden has proposed making the Child Tax Credit. Call Today for a Free Initial Consultation.

We dont make judgments or prescribe specific policies. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Changes in income filing status the birth or.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. IR-2021-201 October 15 2021. Most of us really arent thinking tax returns in mid-October.

Ad We Specialize in the IRS. Six payments of the Child Tax Credit were and are due this year. But many parents want to.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. 13 opt out by Aug.

Wait 5 working days from the payment date to contact us. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. October 14 2021 459 PM CBS DFW.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Climate Action Incentive Payments Caip For 2022 How Much Will You Get Savvynewcanadians

Tds Due Dates October 2020 Dating Due Date Income Tax Return

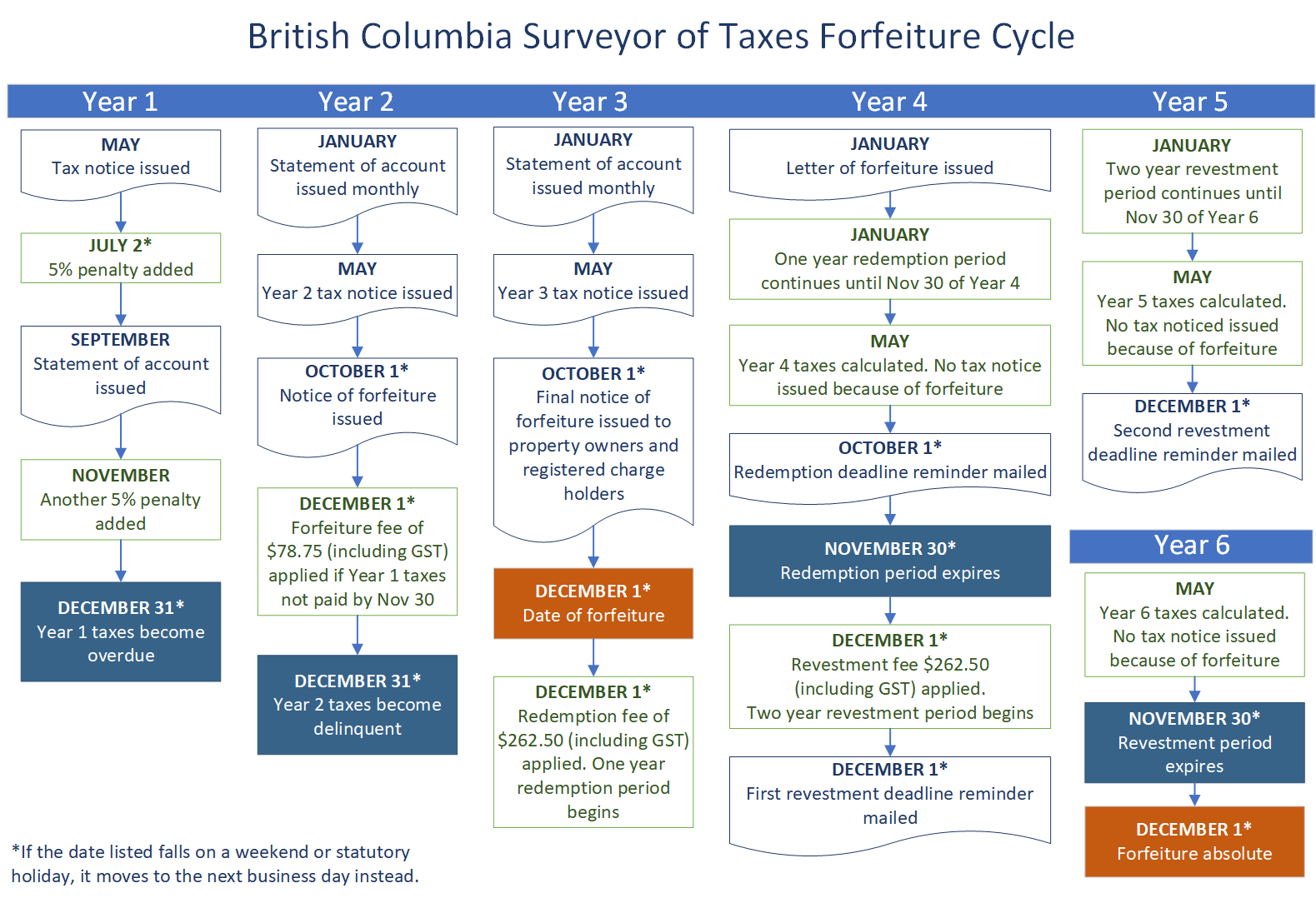

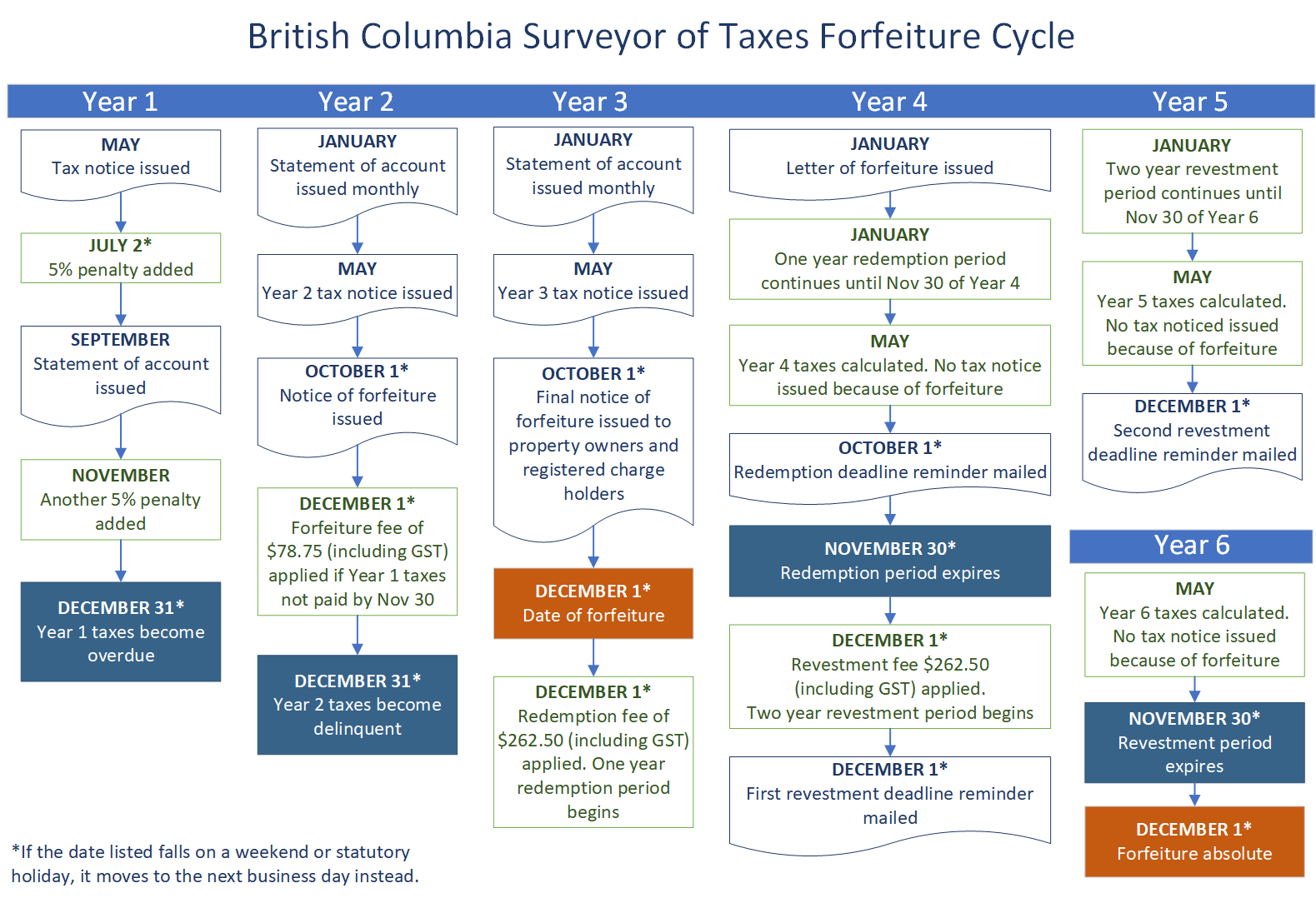

Overdue Rural Property Taxes Province Of British Columbia

Input Tax Credit Tax Credits Indirect Tax Tax Rules

Business Tax Deadline In 2022 For Small Businesses

Canadian Tax News And Covid 19 Updates Archive

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Canada Child Benefit Ccb Payment Dates Application 2022

Lodging Your Tax Return Blacktown Tax Return Business Tax Filing Taxes

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

When Are Taxes Due In 2022 Forbes Advisor