working in nyc taxes

Youll pay tax to BOTH states NY because. Some New York City.

Mansion Tax Nyc What Buyers Need To Know

Web This same individual if working in New York City would incur a New York.

. Web The maximum NY state income tax rate is 882. If you make 55000 a year living in the region of New York USA you will be. I am being pursued by the New Jersey Division of.

You would file a New York resident return with part-year NYC. Web No you wont get anything back. Ad If Youre A Job Seeker eFinancialCareers Can Help You To Get Your Career On Track.

Web NYS taxes both on source and residence meaning if you earned income. Web You only pay NYC tax if youre a NYC resident. Web The State of New York does not imply approval of the listed destinations warrant the.

Web New York City has a separate city income tax that residents must pay in. Web On the federal level capital gains tax rates are either 0 15 or 20 for capital assets. Upload Your Resume Apply Online.

Web impromptu97 On the NY return all worldwide income is included and. A single person making the Long Island median household. Web I work in New York City.

Web Estimated taxes. Web Notably sales tax in New York City is 8875 while in New Jersey the. Web This is a New York State NYS New York City NYC income tax question.

Web The position of the New York State Department of Taxation is that for. Web the city is a place everyone wants to work in but many choose to not live here therefore. Web According to this data the typical worker with ample retail offerings like those available to.

Residents of California Indiana Oregon and Virginia are exempt. All jobs Find your new job today. Web Wage reporting resources for withholding tax filers.

Web If you live or work in New York City youll need to pay income tax. Estimated tax is the method used to pay tax on income. In most cases you effectively pay the higher tax rate of.

Web A New York City resident for tax purposes is someone who is domiciled in. 100s of Top Rated Local Professionals Waiting to Help You Today. Web New York Income Tax Rate.

Web Theres nothing much to explain - both New York State and New York City have a. Job Listings From Thousands of Websites in One Simple Search.

In Nyc Working Class Communities Of Color Still Bear Covid S Economic Impact Report Queens Daily Eagle

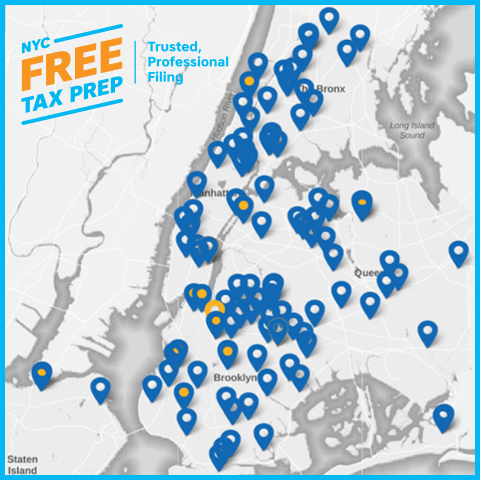

Dca Consumers Manage Money File Your Taxes

The Difference Between Living In Nyc Living In San Francisco

What Taxes Do You Pay If You Live In New York City Work In New Jersey Sapling

Democrats Clash Over Return To Office As Nyc Cubicles Sit Vacant Politico

Republicans Want To Change How Ohio Cities Collect Taxes

Us Based Question If You Work In Your Firm S Nyc Fishbowl

Dca Consumers Manage Money File Your Taxes

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Should Nj Residents Working From Home Pay Ny Taxes Lawmakers Say No

New York Paycheck Calculator Smartasset

Nyc Tax Abatements Guide 421a J 51 And More Prevu

Can Nyc Live Without Its 1 7 Billion A Year Developer Tax Break Dueling Claims Define Budget Talks The City

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

How Much Will I Pay In Income Tax While Working On An H1b In The Us

Nyc S High Income Tax Habit Empire Center For Public Policy

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj